👋 New here? This is one of many YSI projects happening around the world, all year round. All projects are hosted by members of the YSI community. They provide an opportunity to advance your knowledge, and build research collaborations around a pressing economic issue.

- This project has passed.

Money View Reading Group

Money View Reading Group

Location:

Online

Type:

Reading group

Description

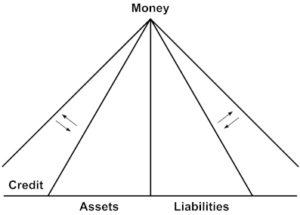

The Money View Reading Group reads and discusses writings on money, banking, and finance. We are a self-directed group. Anyone interested in money and banking can read the readings, join us for discussions, or suggest future readings.

We meet for 90 minutes via Zoom on Mondays at 2 pm Eastern Time US (New York).

Fragile by Design: The Political Origins of Banking Crises and Scarce Credit by Charles W. Calomiris and Stephen Haber (2014)

https://www.amazon.com/Fragile-Design-Political-Princeton-Economic/dp/0691168350/

From the description:

Analyzing the political and banking history of the United Kingdom, the United States, Canada, Mexico, and Brazil through several centuries, Fragile by Design demonstrates that chronic banking crises and scarce credit are not accidents. Calomiris and Haber combine political history and economics to examine how coalitions of politicians, bankers, and other interest groups form, why they endure, and how they generate policies that determine who gets to be a banker, who has access to credit, and who pays for bank bailouts and rescues.

We discuss Section One of Fragile by Design.

- Section One: No Banks without States, and No States without Banks

1 If Stable and Efficient Banks Are Such a Good Idea, Why Are They So Rare? 3

2 The

The Money View Reading Group reads and discusses writings on money, banking, and finance. We are a self-directed group. Anyone interested in money and banking can read the readings, join us for discussions, or suggest future readings.

We meet for 90 minutes via Zoom on Mondays at 2 pm Eastern Time US (New York).

Fragile by Design: The Political Origins of Banking Crises and Scarce Credit by Charles W. Calomiris and Stephen Haber (2014)

https://www.amazon.com/Fragile-Design-Political-Princeton-Economic/dp/0691168350/

From the description:

Analyzing the political and banking history of the United Kingdom, the United States, Canada, Mexico, and Brazil through several centuries, Fragile by Design demonstrates that chronic banking crises and scarce credit are not accidents. Calomiris and Haber combine political history and economics to examine how coalitions of politicians, bankers, and other interest groups form, why they endure, and how they generate policies that determine who gets to be a banker, who has access to credit, and who pays for bank bailouts and rescues.

We discuss Section One of Fragile by Design.

- Section One: No Banks without States, and No States without Banks

1 If Stable and Efficient Banks Are Such a Good Idea, Why Are They So Rare? 3

2 The Game of Bank Bargains 27

3 Tools of Conquest and Survival: Why States Need Banks 60

4 Privileges with Burdens: War, Empire, and the Monopoly Structure of English Banking 84

5 Banks and Democracy: Britain in the Nineteenth and Twentieth Centuries 105

During the off week, we discuss a November 2025 report by Advait Arun from the Center for Public Enterprise entitled “Bubble or Nothing: Data Center Project Finance.”

https://publicenterprise.org/wp-content/uploads/Bubble-or-Nothing.pdf

From the executive summary:

Should economic conditions in the tech sector sour, the burgeoning artificial intelligence (AI) boom may evaporate—and, with it, the economic activity associated with the boom in data center development.

Policymakers concerned about the deployment of clean energy and compute-focused infrastructure over the long term need a framework for managing the uncertainty in this sector’s investment landscape—and for understanding the local and regional impacts of a market correction that strands data centers and their energy projects. This framework requires understanding how a potential downward market correction in the tech sector might occur and, if so, how to sustain investment in critical energy infrastructure assets during potentially recessionary conditions.

We discuss Section Two of Fragile by Design.

- Section Two: The Cost of Banker-Populist Alliances: The United States versus Canada

6 Crippled by Populism: U.S. Banking from Colonial Times to 1990 153

7 The New U.S. Bank Bargain: Megabanks, Urban Activists, and the Erosion of Mortgage Standards 203

8 Leverage, Regulatory Failure, and the Subprime Crisis 256

9 Durable Partners: Politics and Banking in Canada 283

We discuss Sections Three and Four, the final two sections, of Fragile by Design.

- Section Three: Authoritarianism, Democratic Transitions, and the Game of Bank Bargains

10 Mexico: Chaos Makes Cronyism Look Good 331

11 When Autocracy Fails: Banking and Politics in Mexico since 1982 366

12 Inflation Machines: Banking and State Finance in Imperial Brazil 390

13 The Democratic Consequences of Inflation-Tax Banking in Brazil 415 - Section Four: Going beyond Structural Narratives

14 Traveling to Other Places: Is Our Sample Representative? 451

15 Reality Is a Plague on Many Houses 479

- Our Money: Monetary Policy as if Democracy Matters by Leah Downey (2025)

- Treatise on Money by Joseph Schumpeter (1970/2014)

- After the Accord by Kenneth D. Garbade (2021)

- A Study of Money Flows in the United States by Morris Copeland (1952)

- A History of the Greenbacks by Wesley Clair Mitchell (1903)

- Calming the Storms: The Carry Trade, the Banking School and British Financial Crises Since 1825 by Charles Read (2023)

- Benjamin Strong: Central Banker by Lester V. Chandler (1958)

- An Engine, Not a Camera: How Financial Models Shape Markets by Donald MacKenzie (2007)

- Currency and Credit (4e) by Ralph Hawtrey (1950)

- The Golden Age of the Quantity Theory by David Laidler (1991)

- Capitalizing on Crisis: The Political Origins of the Rise of Finance by Greta Krippner (2011)

- The Federal Reserve System by Paul Warburg (1930)

- Central Bank Capitalism: Monetary Policy in Times of Crisis by Joscha Wullweber (2024)

- Introduction to Central Banking by Ulrich Bindseil and Alessio Fota (2021)

- The Chairman: John J. McCloy & The Making of the American Establishment by Kai Bird (1992)

- Manias, Panics, and Crashes (8e) by Robert McCauley (2023)

- The Bailout State: Why Governments Rescue Banks, Not People by Martijn Konings (2025)

- Minsky by Daniel H. Neilson (2019)

2021-03-24 — Discussion Session 1

2021-03-31 — Discussion Session 2

2021-04-07 — Discussion with Daniel Neilson - The Art of Central Banking (Chapter IV) by Ralph Hawtrey (1933)

2021-04-21 — Discussion Session 1

2021-05-05 — Discussion Session 2

2021-05-26 — Discussion with David Glasner - Making Money: Coin, Currency, and the Coming of Capitalism by Christine Desan (2014)

2021-06-02 — Discussion Session 1

2021-06-16 — Discussion Session 2

2021-06-30 — Discussion Session 3

2021-07-14 — Discussion with Christine Desan - Money in a Theory of Finance by John G. Gurley, Edward S. Shaw (1960)

2021-07-21 — Discussion Session 1

2021-08-04 — Discussion Session 2

2021-08-18 — Discussion Session 3 - The World in Depression, 1929-1939 by Charles P. Kindleberger (1973)

2021-09-01 — Discussion Session 1

2021-09-15 — Discussion Session 2

2021-09-29 — Discussion Session 3 - The Rise of Carry by Jamie Lee et al (2019)

2021-10-13 — Discussion Session 1

2021-10-27 — Discussion Session 2 - The Money Interest and the Public Interest by Perry Mehrling (1998)

2021-11-10 — Discussion Session 1 | Allyn Young

2021-11-24 — Discussion Session 2 | Alvin Hanson

2021-12-08 — Discussion Session 3 | Edward Shaw - Controlling Credit by Eric Monnet (2018)

2022-01-05 — Discussion Session 1

2022-01-19 — Discussion Session 2 - The Menace of Fiscal QE by George Selgin (2020)

2022-02-02 — Discussion Session - The New Lombard Street by Perry Mehrling (2011)

2022-02-23 — Discussion Session 1

2022-03-09 — Discussion Session 2

2022-03-23 — Discussion Session 3 - Fighting Financial Crises: Learning from the Past by Gary Gorton, Ellis Tallman (2021)

2022-04-20 — Discussion Session 1

2022-05-11 — Discussion Session 2 - Money and empire: The international gold standard, 1890-1914 by Marcello De Cecco (1974)

2022-05-25 — Discussion Session 1

2022-06-15 — Discussion Session 2 - Central Bank Cooperation 1924-31 by Stephen Clarke (1967)

2022-06-22 — Discussion Session 1

2022-07-06 — Discussion Session 2 - The Money Problem: Rethinking Financial Regulation by Morgan Ricks (2016)

2022-07-27 — Discussion Session 1

2022-08-10 — Discussion Session 2

2022-08-17 — Discussion with Morgan Ricks - The Evolution of Central Banking: Theory and History by Stefano Ugolini (2017)

2022-08-24 — Discussion Session 1

2022-09-07 — Discussion Session 2

2022-09-21 — Discussion Session 3

2022-10-05 — Discussion with Stefano Ugolini - A Financial History of Western Europe by Charles P. Kindleberger (1984, 1993)

2022-10-19 — Discussion Session 1 | Part 1: Money

2022-11-02 — Discussion Session 2 | Part 2: Banking

2022-11-16 — Discussion Session 3 | Part 3: Finance

2023-01-11 — Discussion Session 4 | Part 4: The Interwar Period

2023-01-18 — Discussion Session 5 | Part 5: After World War II - Money and Empire: Charles P. Kindleberger and the Dollar System by Perry Mehrling (2022)

2022-11-30 — Discussion Session 1 | Part 1: Intellectual Formation, 1910–1948

2022-12-14 — Discussion Session 2 | Part 2: International Economist, 1948–1976

2022-12-21 — Discussion Session 3 | Part 3: Historical Economist, 1976–2003

2022-12-21 — Discussion #1 with Perry Mehrling

2023-01-04 — Discussion #2 with Perry Mehrling - Bonds without Borders: A History of the Eurobond Market by Chris O’Malley (2015)

2023-02-15 — Discussion Session 1

2023-03-01 — Discussion Session 2 - Monetary Policy Operations and the Financial System by Ulrich Bindseil (2014)

2023-03-15 — Discussion Session 1 (Ch 1-8)

2023-03-29 — Discussion Session 2 (Ch 9-12)

2023-04-12 — Discussion Session 3 (Ch 13-18) - Capital Wars: The Rise of Global Liquidity by Michael J. Howell (2020)

2023-04-26 — Discussion Session 1 (Ch 1-7)

2023-05-10 — Discussion Session 2 (Ch 8-14) - A Market Theory of Money by John Hicks (1989)

2023-05-24 — Discussion Session 1 (Ch 1-7)

2023-06-07 — Discussion Session 2 (Ch 8-15) - The Currency of Politics: The Political Theory of Money from Aristotle to Keynes by Stefan Eich (2022)

2023-06-28 — Discussion Session 1 (Ch 1 & 2)

2023-07-19 — Discussion Session 2 (Ch 3 & 4)

2023-08-02 — Discussion Session 3 (Ch 5 & 6)

2023-08-14 — Discussion with Stefan Eich - Fischer Black and the Revolutionary Idea of Finance by Perry Mehrling (2005)

2023-08-22 — Discussion Session 1 (Ch 1–5)

2023-09-05 — Discussion Session 2 (Ch 6–8)

2023-09-19 — Discussion Session 3 (Ch 9–11)

2023-09-26 — Discussion with Perry Mehrling - The Evolution of Central Banks by Charles Goodhart (1988)

2023-10-03 — Discussion Session 1 (Ch 1–6)

2023-10-17 — Discussion Session 2 (Ch 7–8, Appendix) - The Repo Market: Shorts, Shortages, and Squeezes by Scott Skyrm (2023)

2023-11-07 — Discussion Session 1 (pages 1–92)

2023-11-21 — Discussion Session 2 (pages 93–186)

2023-12-05 — Discussion Session 3 (pages 187–310) Part 1 — Part 2

2023-12-12 — Discussion with Scott Skyrm From 39:20 - The Volatility Machine: Emerging Economies and the Threat of Financial Collapse by Michael Pettis (2001)

2023-12-19 — Discussion Session 1 (Ch 1–5)

2024-01-02 — Discussion Session 2 (Ch 6–10)

2024-01-09 — Discussion with Michael Pettis - International Capital Movements by Charles P. Kindleberger (1987)

2024-01-16 — Discussion Session 1 (Ch 1 & 2)

2024-01-30 — Discussion Session 2 (Ch 3 & 4) - A Political Theory of Money by Anush Kapadia (2024)

2024-02-20 — Discussion Session 1 (Ch 1–4)

2024-03-05 — Discussion Session 2 (Ch 5–7)

2024-03-19 — Discussion Session 3 (Ch 8–12)

2024-03-26 — Discussion with Anush Kapadia - The Rise of Central Banks: State Power in Financial Capitalism by Leon Wansleben (2023)

2024-04-02 — Discussion Session 1 (Ch 1–3)

2024-04-23 — Discussion Session 2 (Ch 4–6)

2024-05-07 — Discussion with Leon Wansleben - The Money Illusion: Market Monetarism, the Great Recession, and the Future of Monetary Policy by Scott Sumner (2021)

2024-05-14 — Discussion Session 1 (Parts 1 & 2)

2024-05-28 — Discussion Session 2 (Parts 3 & 4)

2024-06-18 — Discussion Session 3 (Parts 5 & 6)

2024-06-25 — Discussion with Scott Sumner - Private Money and Public Currencies: The Sixteenth Century Challenge: The Sixteenth Century Challenge by Boyer-Xambeu, Deleplace, and Gillard (1994)

2024-07-02 — Discussion Session 1 (Ch 1–3)

2024-07-16 — Discussion Session 2 (Ch 4 & 5)

2024-07-30 — Discussion Session 3 (Ch 6, 7 & Conclusion) - The Arena of International Finance by Charles A. Coombs (1976)

2024-08-13 — Discussion Session 1 (Ch 1ー6)

2024-08-27 — Discussion Session 2 (Ch 7–12) - The Bill on London: or The Finance of Trade by Bills of Exchange by Gillett Brothers (1952/1976)

2024-09-17 — Discussion Session - Birth of a Market: The U.S. Treasury Securities Market from the Great War to the Great Depression by Kenneth D. Garbade (2012)

2024-10-01 — Discussion Session 1 (Ch 1–10)

2024-10-15 — Discussion Session 2 (Ch 11–15)

2024-10-29 — Discussion Session 3 (Ch 16–24) - A Monetary and Fiscal History of the United States, 1961–2021 by Alan S. Blinder (2022)

2024-11-12 — Discussion Session 1 (Ch 1–7)

2024-11-26 — Discussion Session 2 (Ch 8–13)

2024-12-10 — Discussion Session 3 (Ch 14–19) - Building a Ruin: The Cold War Politics of Soviet Economic Reform by Yakov Feygin (2024)

2025-01-07 — Discussion Session 1 (Ch 1–3)

2025-01-21 — Discussion Session 2 (Ch 4–6)

2025-02-04 — Discussion Session 3 (Ch 7 & Afterword) - A Crash Course on Crises: Macroeconomic Concepts for Run-Ups, Collapses, and Recoveries by Markus K. Brunnermeier and Ricardo Reis (2023)

2025-02-25 — Discussion Session 1 (Parts 1 and 2)

2025-03-11 — Discussion Session 2 (Parts 3 and 4) - The Empire of Value: A New Foundation for Economics by Andre Orlean (2014)

2025-03-25 — Discussion Session 1 (Introduction and Part 1) Part 1 — Part 2

2025-04-08 — Discussion Session 2 (Parts 2 and 3)

2025-04-22 — Discussion Session 3 (Part 4 and Conclusion) - The Wheels of Commerce by Fernand Braudel (1979/1982)

2025-05-06 — Discussion Session 1 (Chapter 1)

2025-05-13 — Discussion Session 2 (Chapter 2)

2025-05-20 — Discussion Session 3 (Chapter 3)

2025-05-27 — Discussion Session 4 (Chapter 4)

2025-06-03 — Discussion Session 5 (Chapter 5) - Beyond Banks: Technology, Regulation, and the Future of Money by Dan Awrey (2024)

2025-06-17 — Discussion Session 1 (Intro & Ch 1–3)

2025-07-01 — Discussion Session 5 (Ch 4–7 & Conclusion)

2025-07-08 — Author Discussion with Dan Awrey - Our Dollar, Your Problem: An Insider’s View of Seven Turbulent Decades of Global Finance by Kenneth Rogoff (2025)

2025-08-19— Discussion Session 1 (Parts 1-3)

2025-08-26 — Discussion Session 2 (Parts 4-6) - Central Banking Before 1800: A Rehabilitation by Ulrich Bindseil (2019)

2025-09-01 — Discussion Session 1 (Ch 1&2)

2025-09-15 — Discussion Session 2 (Ch 3–5)

2025-09-29 — Discussion Session 3 (Ch 6&7)

2025-10-13 — Author Discussion with Ulrich Bindseil - The Long Twentieth Century: Money, Power and the Origins of Our Times by Giovanni Arrighi (2010)

2025-10-20 — Discussion Session 1 (Ch 1&2)

2025-11-03 — Discussion Session 2 (Ch 3)

2025-11-10 — Discussion Session 3 (Ch 4)

2021-05-19 BIS Working Paper: Breaking free of the triple coincidence in international finance (2015)

2021-07-07 Global Domain of the Dollar: 8 Questions by Robert McCauley Author Discussion

2021-07-28 BIS and Bank of England reports on Central Bank Digital Currencies

2022-09-28 The Crypto Banking System by Sébastien Derivaux (2022) Author Discussion

2023-04-05 Discussion of Silicon Valley Bank

2023-04-19 Institutional Cash Pools by Zoltan Pozsar (2011)

2023-05-03 BIS Bulletin #73: Stablecoins vs. Tokenized Deposits (May 3, 2023)

2023-07-05 The Credit–Money Hierarchy: a Republican , Egalitarian Appraisal by Aaron James (2023)

2023-07-26 Public Purpose Finance: The Government’s Role as Lender by Nadav Orian Peer (2020) Author Discussion 2023-10-24 Money and the Public Debt by Lev Menand and Joshua Younger (2023) | 1

2023-10-31 Money and the Public Debt by Lev Menand and Joshua Younger (2023) | 2

2023-11-14 ICMA Repo FAQ by Richard Comotto (2013/2019)

2023-11-28 Basis Trades and Treasury Market Illiquidity by Daniel Barth & Jay Kahn (2020)

2024-01-23 Capital flows and the current account by Borio and Disyatat (2015)

2024-02-13 The dual currency system of Renaissance Europe by Luca Fantacci (2008)

2024-02-27 BIS: Buy now, pay later: a cross-country analysis by Cornelli et al. (2023)

2024-03-12 The non-use of money in the Middle Ages by Bell, Brooks, and Moore (2017)

2024-04-09 The Central Role of Credit Crunches in Recent Financial History by Albert M. Wojnilower (1980)

2024-04-16 Measuring Equilibrium in the Balance of Payments by Charles P. Kindleberger (1969)

2024-04-30 The Rise and Risks of Private Credit — GFSR (April, 2024)

2024-06-04 BIS Working Paper No 1100: Getting up from the floor by Claudio Borio (May, 2023)

2024-06-11 The Offshore Dollar and US Policy by Robert McCauley (May, 2024)

2024-07-09 The (impossible) repo trinity: the political economy of repo markets by Daniela Gabor (2016)

2024-08-07 A Safe Haven for Hidden Risks (May 30, 2024) and Rate Transformation (November 4, 2023) by Elham Saeidinezhad

2024-08-20 The Collateral Supply Effect on Central Bank Policy by Carolyn Sissoko (2020)

2024-09-10 Monetary Policy Implications of Market Maker of Last Resort Operations by Anil K Kashyap (August 23, 2024)

2024-11-05 BIS Bulletin No 90: The market turbulence and carry trade unwind of August 2024 (August 27, 2024)

2024-11-19 Yen Carry Trade and the Subprime Crisis by Masazumi Hattori and Hyun Song Shin (2009)

2024-12-03 After the Allocation: What Role for the Special Drawing Rights System? by Pforr, Pape, and Murau (2022)

2025-01-14 Where Profits Come From by the Levy Forecasting Center by Levy, Farnham, & Rajan (2008/1997)

2025-01-28 The Broad Consequences of Narrow Banking by Matheus R. Grasseli and Alexander Lipton (2019)

2025-02-11 Failing Banks by Sergio Correia, Stephen Luck, and Emil Verner (2024)

2025-02-18 Odd Lots — The Hidden History of Eurodollars by Lev Menand and Joshua Younger (January 2025)

2025-03-04 Of Last Resort: Evaluating the Treasury-Equity Model of Federal Reserve Emergency Lending by Steven Kelly (2024)

2025-03-18 Commercial Banking and Capital Formation I–IV by Harold Moulton (1918)

2025-04-01 Climate Alignment For Banks: The Stories That Numbers Tell by Nadav Orian Peer (2025) Author Discussion

2025-04-15 Shadow Banking: Why Modern Money Markets are Less Stable Than 19th c. Money Markets But Shouldn’t Be Stabilized by a ‘Dealer of Last Resort’ by Carolyn Sissoko (2014)

2025-04-29 Treasury Market and the Basis Trade (Adrian et al. 2025; Kashyap et al. 2025)

2025-06-10 Structural Changes in the Global Financial System lecture by Hyun Song Shin (May 19, 2025)

2025-06-24 International Regimes, Transactions, and Change: Embedded Liberalism in the Postwar Economic Order by John Gerard Ruggie (1982)

2025-07-15 BIS Annual Report Chapter: Financial conditions in a changing global financial system (2025)

2025-07-22 Banks Are Intermediaries of Loanable Funds by George Selgin (2024)

2025-07-29 Theorising non-bank financial intermediation by Jo Michell (2024)

2025-08-05 Banks are different: why bank-based versus market-based lending is a false dichotomy by Carolyn Sissoko (2024)

2025-09-08 Did France Cause the Great Depression? by Douglas A. Irwin (2010)

2025-09-22 Rethinking Monetary Sovereignty: The Global Credit Money System and the State by Murau and van’t Klooster (2023)

2025-10-06 Rethinking currency internationalisation: offshore money creation and the EU’s monetary governance by Murau and van’t Klooster (2025)

2025-10-27 BIS Bulletin No 114: “Financial channel implications of a weaker dollar for emerging market economies” by Juselius, Wooldridge and Xia (October 13, 2025)

Hosted by Working Group(s):

Not the right project for you?

Take a look at the below.

They are open for applications.

Be the first to know:

Subscribe to the YSI newsletter to find out when new projects go live.